Apart from commodities and the listed property space, April was a month that many investors would prefer to forget. Developed and emerging markets experienced periods of high volatility, with growth stocks and small- to mid-cap names often faring worse for wear. Fears of steep interest rate rises intensified, with the market now expecting the US Federal Reserve (the Fed) to lift US interest rates by 0.5% in early May and signal at least one more similar move in June. Many investors no longer believe that the Fed can hike rates to counter persistently high inflation without tipping the US economy into a recession later this year, or in early 2023.

While local investors were partly shielded from falls in offshore markets by a depreciating Australian dollar, the Dow Jones index finished April below 33,000 points, while the tech-heavy Nasdaq endured its worst month since 2008. In USD terms, the Nasdaq has lost more than 20% this year, cementing its worst start to a year ever. This is consistent with a slump in sentiment, as the percentage of investors describing their six-month outlook for stocks as “bearish” surged to its highest level since 2009.

The dramatic rise in the US 10yr Treasury Note to nearly 3% has clearly spooked investors and is reflective of the sharp sell-off that is taking place in traditional fixed interest markets. Global credit has been particularly hard hit, even though bankruptcy rates have risen only modestly. While domestic bond yields have also surged (as bond prices have slumped), Australia’s higher exposure to resources has led to solid outperformance relative to developed market equity peers over the last three months

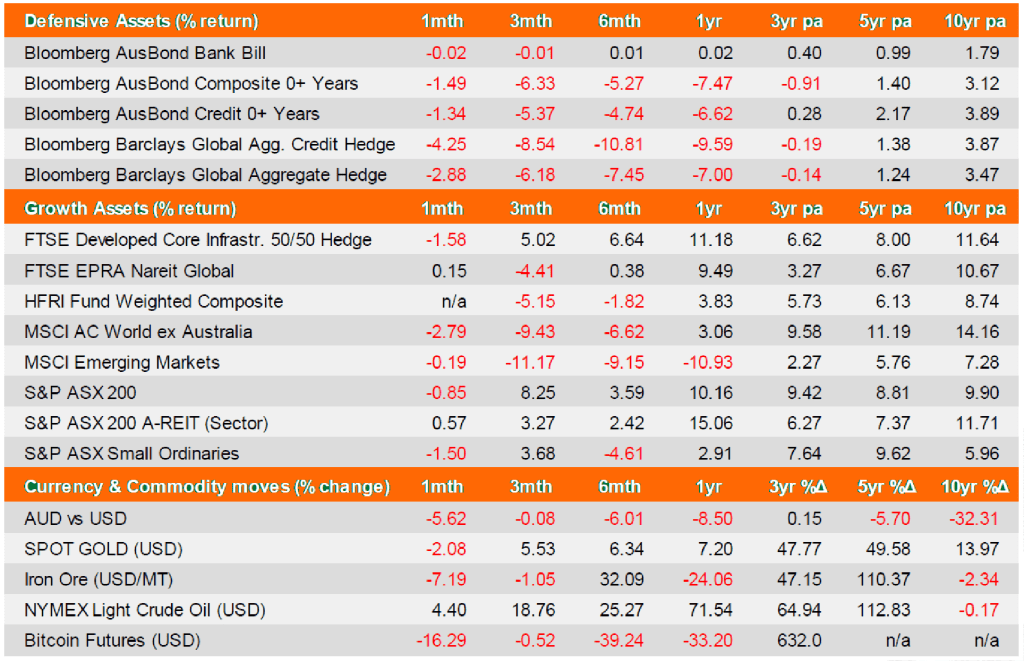

Source: Source: AUD total returns as at 30 April 2022. Defensive and Growth Assets data are sourced from Financial Express; currency and commodity data are sourced from IRESS.

Despite a strong finish to the month, domestic shares posted a loss in April following two months of increases. Much of the losses were due to concerns that aggressive policy tightening by many central banks will derail growth. China’s “zero-Covid” policy and ongoing supply chain constraints due to the Russia-Ukraine conflict also weighed on equities. Sharp increases in packaging andfreight costs reemerged in April. Meanwhile, the US S&P 500 index endured its second worst final trading day of a month dating back to 1993.

Also of note in the US, the only three positive-returning sectors this year (Energy, Consumer Staplesand Utilities), had a combined weighting of just 11% on January 1st. Whereas the three sectors down the most this year (Communication Services, Technology and Consumer Discretionary), had acombined weighting in the S&P 500 of 52% to start 2022. How the mighty have fallen. One reason for the recent pain in growth stocks has been rising bond yields, with the aggregate bond market delivering one of its worst four-month returns since the late 1970s.

The Australian dollar reached three-month lows in late April and tested the key US70c level. The weakness in the local currency is largely due to dynamics that are strengthening the US dollar. For example, the Bank of Japan’s decision to maintain its “ultra-easy” policy stance has sent the yen to its weakest level since 2002 and lifted the greenback to a two-decade high against most major currencies. Helped by favourable interest rate differentials, the US dollar index, which measures the greenback against a basket of six currencies, reached its highest level since December 2002.

On the domestic economic front, the key focus was on the March quarter CPI index, which exceeded even the upper level of most analyst expectations. With headline inflation printing above 5% versus a year ago, many investors brought forward their estimates for when the Reserve Bank (RBA) would commence its rate rising cycle. Financial markets also lifted expectations for where thecash rate would land by December from 2% to 2.5%; and to nearly 3.5% by September next year, equating to 13 hikes.

This is in stark contrast to the language that the RBA had been using prior to the April meeting, where much of the focus was on wage increases, which has remained modest despite a red-hot labour market. In addition, analysts now expect the RBA to upgrade its CPI forecasts, anticipating the December 2022 CPI forecast to climb above 4% from 3.25% in its current forecast, with core inflation easily exceeding 3%, up from 2.75%.

And it’s a similar story in the US, where Fed Funds Rate futures pricing is positioned for at least 1% of tightening by late June. The US labour market is nearing full employment, which is thought to be around 3%, and the housing market has seen prices rise at an astonishing pace. Yet, despite the apparent strength in numerous indicators, the advance estimate of first quarter GDP growth printed in the red. This is due to lower defence spending and a spike in import spending. The jumpin imports came as many businesses as possible and households pulled forward spending in order to beat further expected price rises throughout 2022.

Disclaimer: This economic and market update has been prepared by Evergreen Fund Managers Pty Ltd, trading as Evergreen Consultants, AFSL 486 275, ABN 75 602 703 202 and contains general advice only.

It is intended for Advisers use only and is not to be distributed to retail clients without the consent of Evergreen Consultants. Information contained within this update has been prepared as general advice only as it does not take into account any person’s investment objectives, financial situation or particular needs. The update is not intended to represent or be a substitute for specific financial, taxation or investment advice and should not be relied upon as such.

All assumptions and examples are based on current laws (as at June 2023) and the continuance of these laws and Evergreen Consultants’ interpretation of them. Evergreen Consultants does not undertake to notify its recipients of changes in the law or its interpretation. All examples are for illustration purposes only and may not apply to your circumstances.