Despite the impact of the fast-spreading Omicron Covid-19 variant, markets were generally strong in December. Domestic shares posted another calendar year of positive total returns to investors. Since the height of the GFC, there have been just two years where the key ASX benchmarks (the All Ords and the S&P/ASX 200) have posted negative returns. Indeed, over the last thirty years, there are just five occasions where the top 200 and top 500 shares have finished the year in the red. The average annual total return over the last twenty years has been close to 10%.

Meanwhile, domestic investors holding foreign equities on an unhedged basis have benefited from the weaker Australian dollar over the past decade. This has boosted returns across a number of jurisdictions. The benchmark US S&P 500 has delivered positive Australian dollar-denominated total returns every year for the last ten years, with the average annual return above 20%. The local currency has depreciated by almost 30% against the greenback over the same period.

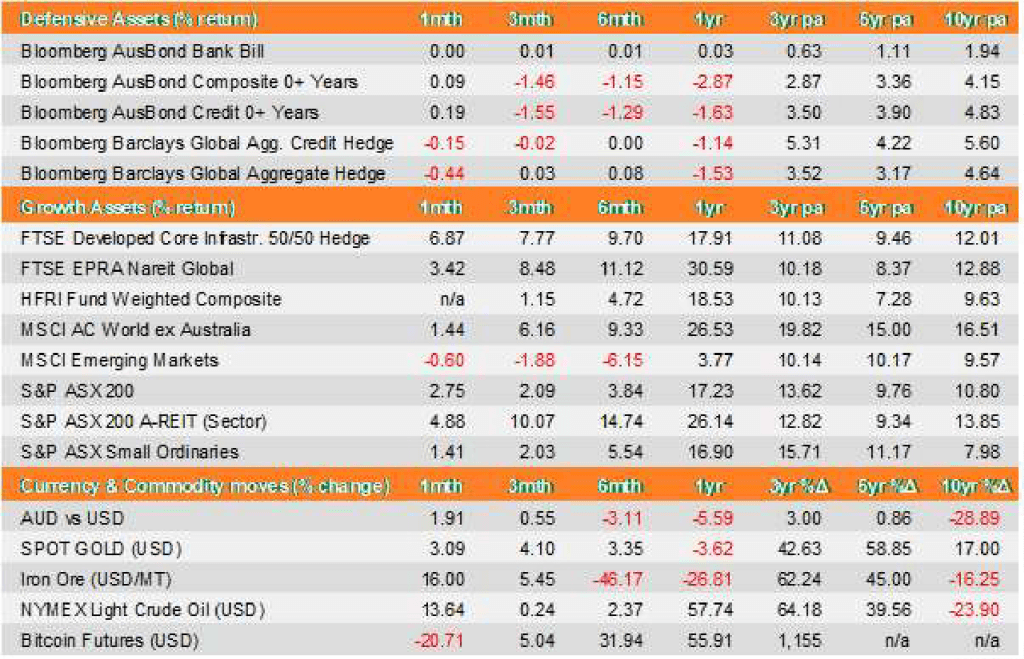

A common factor since the GFC has been exceedingly accommodative monetary policy. This has capped cash returns at very low levels, while proving beneficial for longer duration fixed interest and credit securities. Elsewhere, US dollar gold prices were slightly lower over 2021, while Bitcoin and crude oil prices were sharply higher. However, crypto lost momentum over the last quarter and slumped more than 20% in December, possibly due to the changing trajectory of US monetary policy. Markets are expecting the prompt removal of quantitative easing (QE) policies and for official rates to rise in 2022.

Source: Evergreen Consultants, Financial Express, AUD total returns as at 31 July 2022.

As Covid-19 cases swept across the world in December, even the most highly vaccinated nations were not spared. But the European, US and Australian markets continued to rally as most Omicron infections to date have been relatively mild. As mentioned in our introduction, it was yet another positive year for domestic investors holding ASX-listed shares. Telecommunications was the best performing sector in 2021, led by a rebound in Telstra. The listed property sector, financials and consumer discretionary sectors also performed strongly. At the opposite end of the spectrum were the energy and information technology sectors, with the latter seeing its valuations hit heavily by rising risk-free rates. Every stock in the top 20 delivered positive returns in 2021, led by Macquarie Group (52.7%), while Coles Group generated a 2.3% total return to investors.

In the US, the S&P 500 had another strong year, despite escalating uncertainty around inflation trajectories and its impact on monetary policy. The benchmark index registered 70 record-high closes in 2021 – the second-most ever. Using Refinitiv data back to 1928, the most record-high closes for the S&P 500 in a single year was 77 in 1995. Meanwhile, in US dollar terms, the Dow Jones added 18.7% for the year, and the Nasdaq gained 21.4%.

The VIX (volatility index) ended the year at 17.2. The volatility measure spiked to more than 31 in early December as news of the Omicron variant broke. The energy, real estate and microchips sectors were among 2021’s top performers. Dow Transports, considered by many a barometer of economic health, registered a yearly gain of more than 31%. Steadily rising Treasury yields, along with a recent hawkish shift from the Federal Reserve (which now foresees as many as three rate hikes in 2022), supported the interest rate-sensitive financials sector, which gained nearly 33% during the year.

On the domestic economic front, growth for the September quarter exceeded expectations as the lockdown-adapted Victorian economy avoided a repeat of previous slumps following yet another lockdown. Despite earning the title of the world’s most locked down city, Melbourne found ways to minimise the disruptive impacts of pandemic-related restrictions. The economy is now 0.2% smaller than pre-Covid levels. In other news, hours worked surged in November as employment skyrocketed. The unemployment rate fell to 4.6% despite rising workforce participation.

The US also enjoyed strong employment data for November, with the unemployment rate falling to 4.2%, while average wages gained nearly 5% over the preceding five months. On the closely-watched inflation front, consumer and producer price growth remains elevated, with core readings that exclude food and energy, reaching multi-decade highs. It was a similar story throughout Europe as consumer inflation continued to rise, while producer inflation posted the largest yearly increase on record.

Finally, in Emerging Markets, China came under renewed pressure as the Evergrande debt crisis escalated and retail sales again missed expectations. House prices continued to weaken and authorities implemented new restrictions to deal with the spread of the Omicron variant.

Disclaimer: This economic and market update has been prepared by Evergreen Fund Managers Pty Ltd, trading as Evergreen Consultants, AFSL 486 275, ABN 75 602 703 202 and contains general advice only.

It is intended for Advisers use only and is not to be distributed to retail clients without the consent of Evergreen Consultants. Information contained within this update has been prepared as general advice only as it does not take into account any person’s investment objectives, financial situation or particular needs. The update is not intended to represent or be a substitute for specific financial, taxation or investment advice and should not be relied upon as such.

All assumptions and examples are based on current laws (as at June 2023) and the continuance of these laws and Evergreen Consultants’ interpretation of them. Evergreen Consultants does not undertake to notify its recipients of changes in the law or its interpretation. All examples are for illustration purposes only and may not apply to your circumstances.