Renewed volatility in January saw investors get off to a bumpy start in 2022. Rising inflationary expectations and an above-consensus US CPI read rocked markets and added to a wall of worry that also featured rising tensions between the US, Russia and Ukraine. The threat of financial conditions tightening (as central banks remove QE and hike interest rates) was particularly savage for growth stocks across the spectrum, from those with no earnings to high quality cash-rich tech giants. At the peak of the selling, share markets in most regions registered technical corrections (losses of at least 10%). Much focus was placed on the tech-heavy US NASDAQ Composite Index, which at one point had shed more than 16% in US dollar terms, before staging a late rally to be down 9% at month’s end.

Domestic shares also came in for a battering, with investors incurring steep losses in January. Small cap and interest rate sensitive property stocks were hard hit. But the Info Tech space bore the brunt of the selling, as investors confronted losses approaching 20%. Energy was the best performing sector, as oil prices surged on geopolitical tensions and lower inventories. Higher commodity prices boosted the resources sector, while Utilities posted positive gains, with the latter seen as a more defensive play.

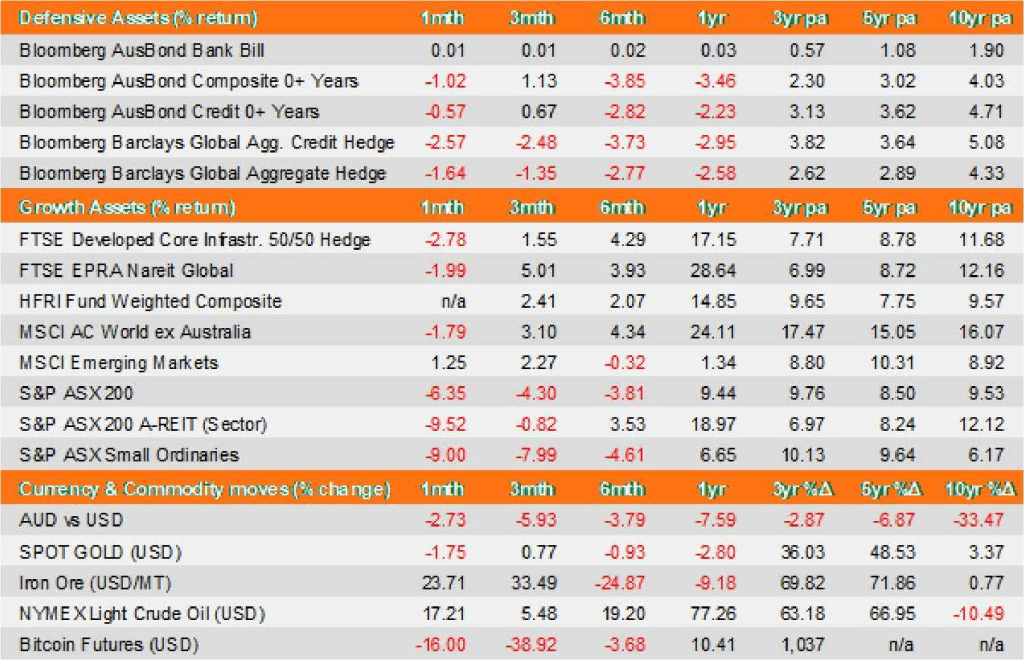

Rising risk-free rates meant that traditional fixed interest also lost ground in January. Global credit was hardest hit as investor concern about rising borrowing costs in Omicron-disrupted, slowing economies increased. Elsewhere, despite heightened inflation fears, gold prices fell slightly and crypto took another leg down, with Bitcoin shedding a further 16% as sentiment soured.

Source: AUD total returns as at 31 January 2022. Defensive and Growth Assets data is sourced from Financial Express; currency and commodity data is sourced from IRESS.

The S&P/ASX 200 posted its biggest monthly drop since Covid-19 first hit about two years ago. The index plunged to as far as 6758.2, a level last seen in March 2021. And the Australian dollar was not spared, falling below US70¢ to its weakest level in eighteen months as markets digested the implications of a hawkish US Federal Reserve. The weakness in the Australian dollar came despite a sharp rise in iron ore prices during the month, reaching levels not seen since August. The bulk commodity’s rally was attributed to restocking demand in China ahead of the Lunar New Year holiday commencing in early February.

The risk-off environment, exacerbated by rising geopolitical tensions in eastern Europe, led to a savage sell-off in Developed Market equities as a spike in bond yields and oil prices drove an intra-month technical correction in shares. The valuation impact on growth shares was most pronounced and contributed to the largest monthly outperformance of value versus growth in more than twenty years. Despite substantial short-term underperformance, growth indices continue to trade at a large premium to value indices.

The prospect of interest rate hikes was of particular concern to investors. In Australia, the market is now pricing in four cash rate rises this year, in addition to the removal of the RBA’s asset purchase program (a switch from quantitative ‘easing’ to ‘tightening’). And it is a similar theme in key regions across the globe, such as the US, UK and Europe. Global bond markets declined, but still outperformed equities. Even so, the falls delivered a stern warning to investors that in times of heightened inflationary risks, bonds lose some of their defensive attributes, compared to periods of recessionary risk.

On the domestic economic front, credit expanded at a brisk pace in the second half of 2021, lifting annual growth to a thirteen-year high as businesses accessed loans during the lockdown. But most attention was focused on the December quarter CPI release, which exceeded expectations and suggested that price rises still had further to run. Annual consumer inflation had reached 3.5% in 2021 and underlying inflation was now at the upper end of the RBA’s target band. Rising energy prices was a key contributor, and there was no respite in January as Brent oil reached US$90 a barrel for the first time since October 2014. Strong labour market data saw to a sharp fall in the unemployment rate, with conditions ripe for a long-awaited acceleration in wages growth.

For the US, despite an Omicron-induced slowdown in activity during January, inflation and employment data resembled the experience in Australia (and many other regions). Unemployment fell below 4%, while inflation rose by 7% in 2021. With strong wages growth continuing, investors are positioning for more interest rates rises than is currently being guided by the US Federal Reserve.

Finally, in Emerging Markets, China’s economy grew faster than expected in the December quarter, as weak domestic demand was offset by the external sector. Fixed asset investment decelerated and consumer sentiment remained subdued, with retail sales barely growing in 2021. The GDP data boosted share market returns, even as sharp producer price rises ate into corporate margins.

Disclaimer: This economic and market update has been prepared by Evergreen Fund Managers Pty Ltd, trading as Evergreen Consultants, AFSL 486 275, ABN 75 602 703 202 and contains general advice only.

It is intended for Advisers use only and is not to be distributed to retail clients without the consent of Evergreen Consultants. Information contained within this update has been prepared as general advice only as it does not take into account any person’s investment objectives, financial situation or particular needs. The update is not intended to represent or be a substitute for specific financial, taxation or investment advice and should not be relied upon as such.

All assumptions and examples are based on current laws (as at June 2023) and the continuance of these laws and Evergreen Consultants’ interpretation of them. Evergreen Consultants does not undertake to notify its recipients of changes in the law or its interpretation. All examples are for illustration purposes only and may not apply to your circumstances.