The 2022 financial year ended with markets well and truly in the red. The US share market was particularly

savaged. To put this into context, the S&P 500 posted its worst first half to a calendar year in more than half a

century. All three major US stock indexes finished the month and the June quarter in negative territory, with the

Nasdaq delivering its largest-ever January-June percentage drop, while the Dow suffered its biggest first-half

percentage plunge since 1962. Adding salt to the wound, all three indices posted consecutive quarterly declines.

The last time that happened was in 2015 for the S&P 500 and the Dow, and 2016 for the Nasdaq.

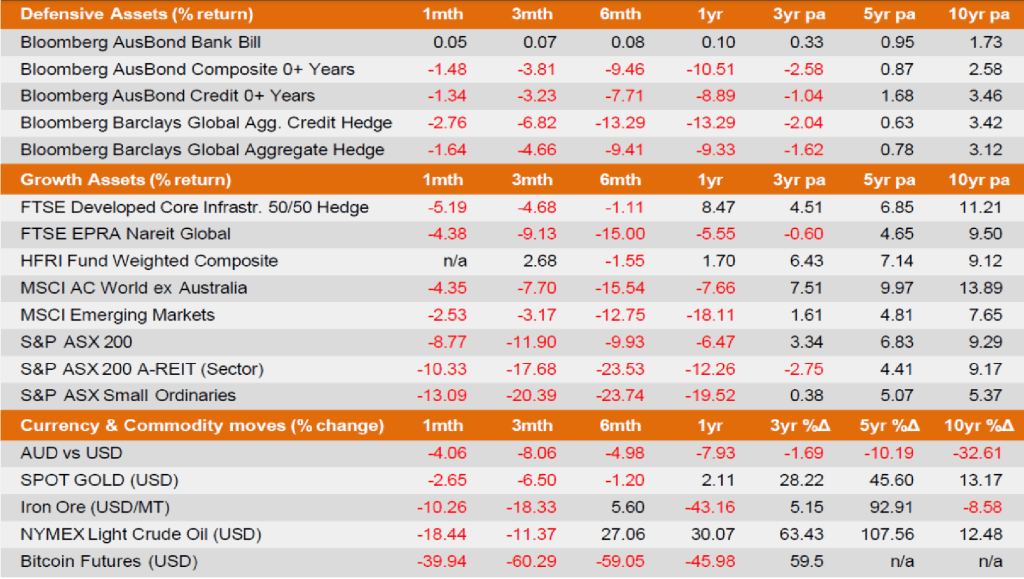

The Australian S&P/ASX 200 Index finished the financial year down 6.5% and slumped nearly 9% in the month of

June as rising interest rates and higher inflation forecasts rattled investors. Leading the charge lower was the Tech sector, which has shed more than a third of its value over the past six months as rising risk-free rates sunk

valuations. In stark contrast, the much-maligned Energy and Utilities sectors surged higher as oil and gas prices

were propelled upward by the Russia-Ukraine war.

Meanwhile, traditional fixed interest markets experienced an horrendous six-month period. Persistently higher than-expected inflation was coupled by sharply rising interest rates and the inception of quantitative tightening (QT), as central banks tried to unwind emergency settings that were designed for the depths of the pandemic. Elsewhere, commodity prices began to roll over and the rout in crypto markets continued as structural deficiencies rose to the fore.

Developed market equities endured their worst first half in over fifty years. A multitude of factors conspired to up-end investor hopes of a slowdown in inflation, while raising interest rate expectations to levels that would likely leave consumers and investors reeling from higher borrowing costs and possibly bring about a global recession.

In 2022, it seems that cash has been the only safe hiding place for investors, with all major asset classes delivering negative returns. While hedge funds and infrastructure have been relatively shielded from this year’s carnage, listed property and small caps have seemingly borne the brunt of the impact in markets. Property has not responded well to rising interest rates and small cap industrials (in particular) have been the victim of vanishing liquidity.

Elsewhere, the weaker Australian dollar has provided only limited relief for unhedged investors. Meanwhile, gold has found strong support from the governments of Russia and China, as these nations seek to mitigate the economic impact of punitive policy moves by major western powers on their financial systems. Finally, crypto investors have experienced yet further disappointment with a 60% drawdown this year alone. Some exchanges have collapsed as investors sought to flee crypto in their droves, with rising interest rates crunching liquidity and adding to the sector’s woes.

On the domestic economic front, there has been a laser-like focus on the Reserve Bank (RBA) and the trajectory it will take in its efforts to stamp out inflation. The official cash rate moved 0.5% higher in early June to 0.85%, surprising most economists and market analysts. The RBA also raised its CPI inflation projections for 2022 to 7%, more than triple its 2.25% forecast in November 2021. With interest rates on the rise, bond market investors again revisited expectations for the cash rate by year end and mid-2023. If their positioning for a 3%+ cash rate by Christmas comes to fruition, many investors fear that this would plunge Australia into recession.

Other notable events in the month were the release of the national accounts for the March quarter, which revealed that GDP expanded by 0.8% in the period and 3.3% through the preceding twelve months. Elsewhere, the Fair Work Commission handed down a 5.2% increase in the minimum wage, while pointing to 6.6% inflation in non-discretionary items. Unemployment remained below 4%.

Among global economies, the US is experiencing a collapse in consumer confidence as high inflation, rising interest rates and a surge in fuel prices have eaten into disposable income and purchasing power. The Federal Reserve raised interest rates by 0.75% in its June meeting to 1.5%–1.75%, above market expectations. The median Fed member now expects interest rates to reach 3.8% by the end of next year, but for GDP growth this year to reach just 1.7%. Higher interest rates are already starting to weigh on economic activity, with housing construction slowing and retail sales falling in real terms. In the UK, near double-digit inflation and stagnating growth seems to have brought a return of stagflation. House prices have stalled and economic uncertainty continues to grow. On a positive note, Covid restrictions eased in China and this led to a recovery in Emerging Markets, more broadly. Even so, China looks likely to miss its ambitious 2022 economic growth target of 5.5%.

Disclaimer: This economic and market update has been prepared by Evergreen Fund Managers Pty Ltd, trading as Evergreen Consultants, AFSL 486 275, ABN 75 602 703 202 and contains general advice only.

It is intended for Advisers use only and is not to be distributed to retail clients without the consent of Evergreen Consultants. Information contained within this update has been prepared as general advice only as it does not take into account any person’s investment objectives, financial situation or particular needs. The update is not intended to represent or be a substitute for specific financial, taxation or investment advice and should not be relied upon as such.

All assumptions and examples are based on current laws (as at June 2023) and the continuance of these laws and Evergreen Consultants’ interpretation of them. Evergreen Consultants does not undertake to notify its recipients of changes in the law or its interpretation. All examples are for illustration purposes only and may not apply to your circumstances.