May proved to be a rollercoaster for financial markets following a reversal of fortune that prevented a bear market in equities and more pain for bond investors. Investors reacted to the continuing war in Ukraine and Covid outbreaks in China, which raised concerns about global commodities and supply chain challenges.

At the start of May, the US Federal Reserve (the Fed) hiked interest rates by half a percent in a bid to dampen inflation that had reached forty-year highs. (Australia’s central bank raised the official cash rate by 0.25%.) Recession fears have mounted as investors fear the Fed’s policy tightening will trigger an economic decline. In local currency terms, the US S&P 500 finished the month little changed, while the tech-heavy Nasdaq finished in the red. Disappointing quarterly reports from the likes of Walmart and Snap showed inflation was hurting American consumers and eating into corporate profits.

Domestic shares fared less well than many of its global peers, losing 2.6% for the month after accounting for dividends, which buffered the decline by 0.4%. Small caps performed poorly, losing 7% in May and delivering negative total returns over the preceding twelve-month period. In broad terms, the Resources sector performed best, while Technology and listed property came under fierce selling pressure. In the case of the latter, rising real yields (i.e., higher bond market interest rates not caused by changing inflationary expectations) savaged property returns. Property is an example of a “real asset”, where valuations are much more sensitive to changes in real yields.

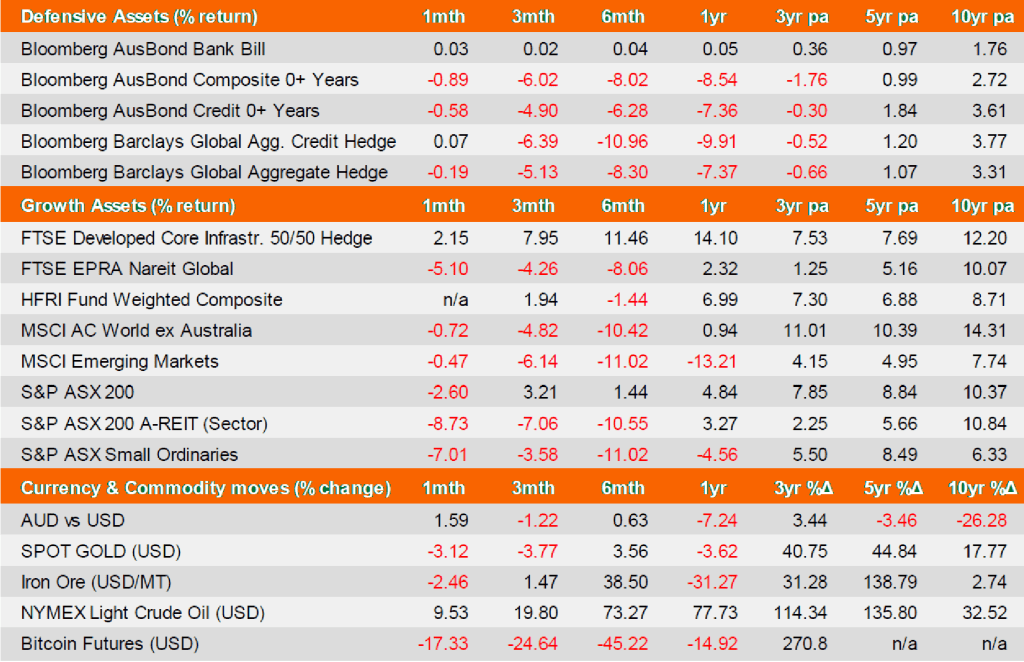

Source: Source: AUD total returns as at 31 May 2022. Defensive and Growth Assets data are sourced from Financial Express; currency and commodity data are sourced from IRESS.

Despite a strong finish to May, domestic shares posted consecutive losses. Technology and Real Estate Investment Trusts underperformed, while Energy, Banks, and Resources more broadly, had a positive month. After the March quarter CPI inflation figures printed well above consensus in late April, markets expected the Reserve Bank to raise rates at the May meeting ─ and they were not disappointed. However, the size of first increase since 2010 of 0.25% surprised analysts, who were anticipating a minimal 0.15% move. This led to significant changes in interest rate expectations throughout the month that can be perhaps best characterized as “overshooting”.

Elsewhere, US stocks struggled during the month amid ongoing elevated uncertainty around the path of the economy. The S&P 500 on May 20 dipped into bear-market territory briefly, falling 20% below its high at one point during the session. Meanwhile, the Dow endured its longest weekly losing streak since 1923, falling for eight consecutive weeks before staging a counter-trend rally late in the month. Indeed, the final week of May saw the Dow and the S&P 500 notch their best weekly gains since November 2020.

A large weighting to the energy sector continued to benefit UK equities. The FTSE 100 remains the only positive equity market year-to-date in local currency terms. Emerging Markets were again volatile in May, as China’s Covid-related lockdowns accompanied rising interest rates in Developed Markets to initially savage returns, before staging a powerful rally to round out the month. No stranger to volatility, Bitcoin plummeted during the month and delivered another double-digit loss for holders of crypto.

On the domestic economic front, the labor market printed a 48-year low unemployment rate of 3.85%. But this this was not enough for the then Treasurer to retain his seat in the parliament, going down to a well-funded “teal” Independent. Indeed, the Australian federal election saw a change in government and a swing away from the major parties to the minor parties and independent candidates. The ALP secured a majority of 77 seats in the lower house but will need to negotiate with the cross benches in the Senate if it is to implement its desired legislative program.

On the Continent, inflation data showed that Eurozone annual CPI hit a record 8.1% in April amid surging energy and food costs, fueled in part by Russia’s war in Ukraine. Energy prices jumped nearly 40% versus a year ago, while food prices were 7.5% higher. The president of the European Central Bank, Christine Lagarde, gave the clearest sign yet that rate will start rising soon, writing on a blog that she expects to “exit negative interest rates by the end of the third quarter”. CPI inflation in the Eurozone is now at its highest level since record keeping for the Euro began in 1997.

Finally, in the US, the Gallup Economic Confidence Index (ECI) reading for May came in at negative 45. It was negative 39 in both March and April. The index is a summary measure of Americans’ perceptions of current economic conditions and their outlook for the economy. It has a theoretical range of plus 100 (if all respondents say the economy is excellent or good and that it is getting better) to minus 100 (if all say it is poor and getting worse), while zero is neutral.

Disclaimer: This economic and market update has been prepared by Evergreen Fund Managers Pty Ltd, trading as Evergreen Consultants, AFSL 486 275, ABN 75 602 703 202 and contains general advice only.

It is intended for Advisers use only and is not to be distributed to retail clients without the consent of Evergreen Consultants. Information contained within this update has been prepared as general advice only as it does not take into account any person’s investment objectives, financial situation or particular needs. The update is not intended to represent or be a substitute for specific financial, taxation or investment advice and should not be relied upon as such.

All assumptions and examples are based on current laws (as at June 2023) and the continuance of these laws and Evergreen Consultants’ interpretation of them. Evergreen Consultants does not undertake to notify its recipients of changes in the law or its interpretation. All examples are for illustration purposes only and may not apply to your circumstances.