November once again threw a Covid curveball. But unlike the vaccine announcements of 2020, this year saw a new strain of concern, called Omicron, with the WHO skipping the letters Nu and Xi for political reasons. The Omicron announcement immediately led to a risk-off environment, which saw domestic shares give up its gains and end the month in the red.

Meanwhile, renewed interest in bonds pushed yields lower and helped property stocks add to the gains of October. Indeed, domestic listed property has easily outperformed the broader market over the past three, six and twelve months. And due to the timing of the base effects from the GFC, the A-REIT sector (which was slower to recover) has also outperformed over ten years to 30 November. Global property and unhedged infrastructure also performed well as investors poured into real assets.

Despite global equities generally declining in local currency terms in November, domestic investors benefitted from the much larger fall in the Australian dollar. There was a worrying rise in Covid-related hospitalisations in Europe and, subsequently, the US, which could increase in the northern winter.

Perhaps the biggest economic news of the month was the latest “Powell pivot”, with the Chief of the US Federal Reserve implying that there would be an acceleration of the QE tapering program. That would open the door to interest rate hikes thereafter. Jerome Powell also said: “it’s probably a good time to retire that word (transitory)” to describe inflation. Yet, in August at his much-anticipated Jackson Hole speech, he presented a one-sided case for why price pressures were no reason for alarm.

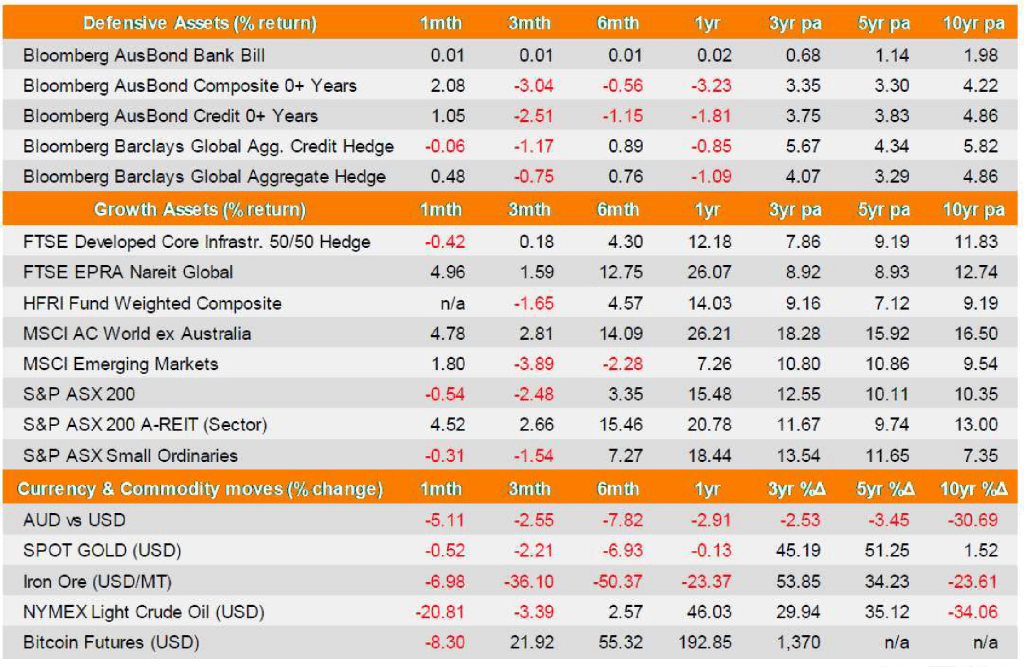

Source: Evergreen Consultants, Financial Express, AUD total returns as at 30 November 2021, unless expressed otherwise.

The main event in November was the emergence of the Omicron Covid-19 variant, which was thought to have originated in southern Africa. However, there is now data emanating from Europe that suggests this variant may have been present in the Netherlands some weeks beforehand. Fears arounds its high level of transmissibility sparked increased volatility in equity and bond markets. Most at risk were stocks in the travel-related sector and sub-investment grade debt, with sharp sell-offs the order of the day. However, markets seemed less concerned by the end of the month when reports showed that Omicron may be less lethal than Delta, with many cases asymptomatic. As a precaution, border rules were tightened across several regions, including Australia and the US.

While all major developed and emerging market indices posted negative returns in local currency terms, the significant fall in the Australian dollar meant that local investors typically made gains on unhedged exposures. The Australian dollar’s circa 5% decline against the greenback was the largest since the onset of the pandemic and its falls gained momentum as the month drew to a close. The Australian dollar fell on a sharp retracement of oil prices as the new Covid outbreak threatened the reopening and on a further weakening in iron ore as China’s domestic demand continues to struggle on weak consumption spending.

In fixed income, markets staged a revival following the difficulties encountered in October, particularly for Australian fixed interest. The benchmark domestic composite bond index gained more than 2% and domestic credit also rose by just over 1%. The benchmark global bond index gained nearly 0.5% in Australian dollar terms as investors became more cautious.

On the domestic economic front, retail trade for September was confirmed to have slumped as the confidence-crushing effects of lockdowns in NSW and Victoria saw households prefer to increase savings. Meanwhile, wages continued to rise only modestly in the September quarter and were just 2.2% higher over the preceding year. With annual inflation exceeding 3%, this implies that real wages fell over the same period. As lockdowns came to an end in October, more workers re-entered the labour force, but struggled to find jobs leading to a jump in the unemployment rate. This came despite some industries complaining that workers are in short supply and big business called for a large migration program to be implemented immediately.

In the US, all eyes were on Fed Chief Jerome Powell who, in his Senate Banking Committee testimony, proceeded to pivot the Fed into inflation-fighting mode. He noted that “factors pushing inflation upward will linger well into next year”. But, he also went out of his way to emphasise that price pressures were becoming broader than just a few items. Large upward revisions in jobs growth for previous months may have contributed to Powell’s latest pivot. In Europe, economic data were mixed in November, as euro area manufacturing rebounded, following three months of decline. Economic momentum remained strong in the UK as it has been less affected by the latest Covid-19 wave. Consumer confidence and retail sales have increased, in contrast to what has been observed in Europe. In China, exports staged a rebound, while Evergrande made overdue coupon payments.

Disclaimer: This economic and market update has been prepared by Evergreen Fund Managers Pty Ltd, trading as Evergreen Consultants, AFSL 486 275, ABN 75 602 703 202 and contains general advice only.

It is intended for Advisers use only and is not to be distributed to retail clients without the consent of Evergreen Consultants. Information contained within this update has been prepared as general advice only as it does not take into account any person’s investment objectives, financial situation or particular needs. The update is not intended to represent or be a substitute for specific financial, taxation or investment advice and should not be relied upon as such.

All assumptions and examples are based on current laws (as at June 2023) and the continuance of these laws and Evergreen Consultants’ interpretation of them. Evergreen Consultants does not undertake to notify its recipients of changes in the law or its interpretation. All examples are for illustration purposes only and may not apply to your circumstances.

Liability limited by a scheme approved under Professional Standards Legislation.